established fact

Benjamin Franklin said,

"An investment in knowledge

pays the best interest"

Retirement Education

Investment Calculator

Building enduring portfolio strategy

Keeping it simple money management

The 13 worst recessions depressions and panics in american history

The real impact of losses and what losses can mean to a retiree's portfolio

Time is money if you lose it. It takes time

Understanding impact of losses

Understand impact of minimizing losses

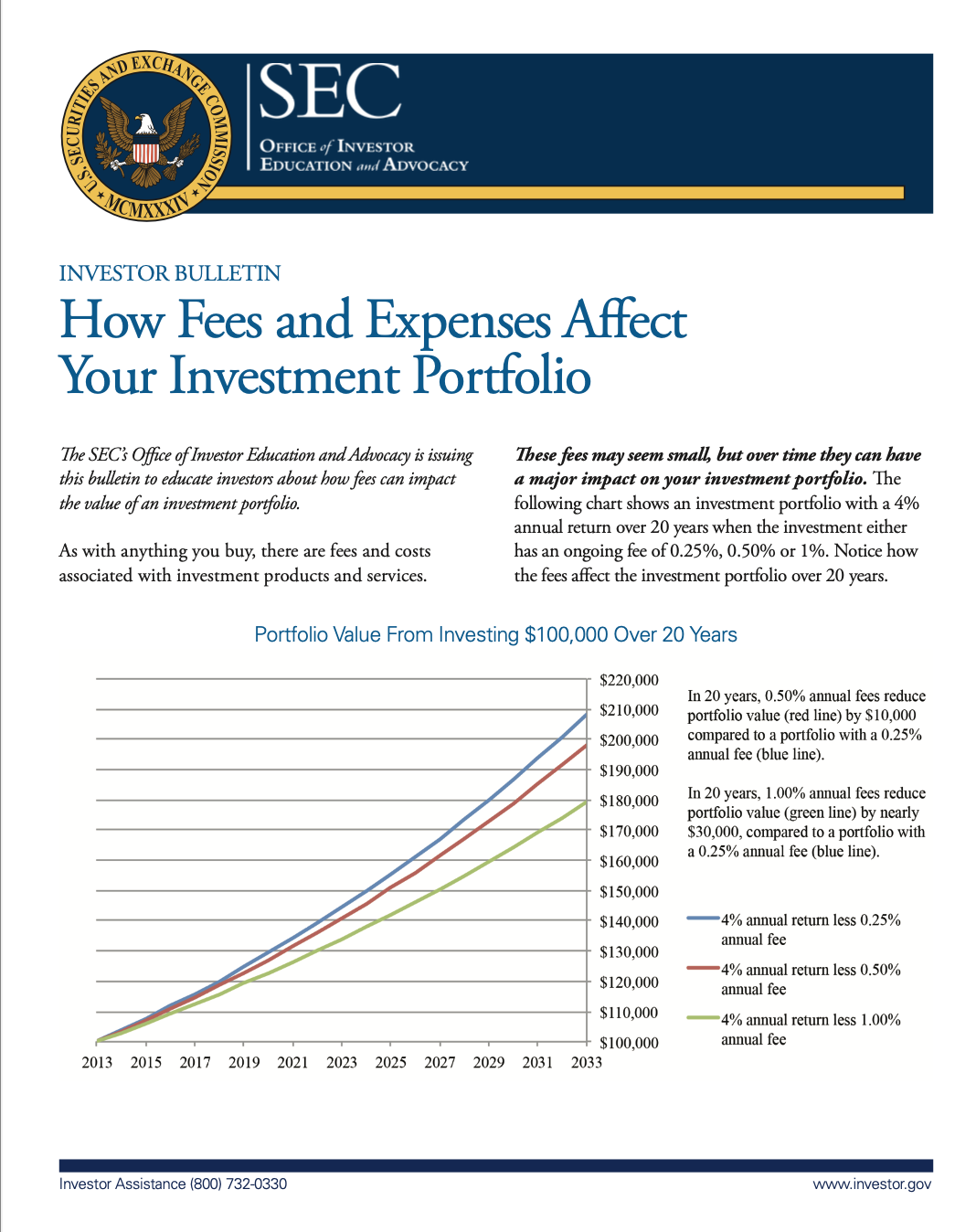

Understanding investment fees and its impact

Ways to maximize your social security

When a nation’s finances is out of balance because politicians are fiscally irresponsible, three options presents itself:

- Increase Taxes

- Reduce Spending

- Print Money

What do you think Politicians prefer? If you say all three, you are correct. But the easiest of all is to print money, and that is what politicians endeavor. However, this is ruinous to any nation that engages in such as it creates a bust/boom cycle anchored in deflation, inflation, and devastating debt purge that consumes the future.

A testament is the fact that the US. dollar has lost more than 95% of its value and purchasing power since the Federal Reserve was established. There are lessons to learn from the trouble of Pharaoh in his dreams, the collapse of the Roman Empire, the French debt crisis of the mid 1700s and the ensuing revolution, the long depression of 1873 to 1896 (depending on how it is measured March 1797), our own 1907 panic and the great depression of 1929-1939, the Japanese lost decade, and the cost of the 2007-2008 financial crisis!

What comes next? Anybody’s guise!! Is your investment and by extension your retirement secure? Can you retire well? These are questions to ponder in the formulation and the implementation of your financial action plan.

Retirement is the period to relish in and harvest the fruits of your hard work over the years. Your worries should be few, but is it? The following are risks that can stand in your way of a comfortable, stress free retirement, and the growing of your money without losing it:

- Taxes

- Catastrophic Illness

- Financial Market Volatility (Up today, down tomorrow)

- Living Long and Planning Short – You run out of resources due to longevity

- Inflation

- Legal entanglements and hurdles

- Premature Death

How well you prepare and manage these risks determine how well you retire. Do you understand them, and do you have an actionable plan that makes you prepared?

Key Factors to Consider:

- Required Minimum Distributions (RMDs): Required Minimum Distribution are the minimum amounts you must withdraw from a retirement account such as IRA, SEP IRA, SIMPLE IRA, and other retirement plans when you are 72 or older if achieved after December 31, 2022, at age 73. If 401(k) or in a profit sharing plan, until the year of retirement except if you are a 5 percent owner of the sponsoring business. Roth IRA does not require distribution beginning April 1, 2024. All withdrawals are includable in taxable income.

- Tax-Deferred Accounts: Roth IRAs and Roth 401(k)s allow you to contribute after-tax dollars. The earnings grow tax-free, and qualified withdrawals are tax-free in retirement.

- Social Security Benefits: The portion of your Social Security benefits that is taxable depends on your combined income. Knowing your tax bracket is crucial to determine how much of your benefits will be subject to tax.

- Tax Deductions and Credits: You may be eligible for tax deductions and credits that can reduce your overall tax liability, such as charitable contributions and tax credits for certain medical expenses.

Strategies for Retirement Tax Planning:

- Maximize Tax-Deferred Contributions: Contribute to Roth IRAs or Roth 401(k)s to grow your retirement savings tax-free.

- Consider Converting Traditional IRAs to Roth IRAs: If you have a high income, consider converting your traditional IRA to a Roth IRA. While you'll pay taxes on the conversion, future withdrawals will be tax-free.

- Optimize Social Security Benefits: Delay taking Social Security benefits if possible to receive a higher monthly payment. However, be mindful of the potential tax implications.

- Harvest Tax Losses: If you have investments that have lost value, selling them and reinvesting in similar assets can help offset capital gains taxes.

- Utilize Qualified Retirement Plans: Take advantage of qualified retirement plans like 401(k)s and traditional IRAs to defer taxes on your contributions and earnings.

- Consider Tax-Efficient Investment Strategies: Choose investments that have a history of lower tax burdens, such as municipal bonds.

Video Resources

Steps To Better Money Management

Video courtesy of DuckDuckGo.